Exchange-Traded Funds (ETFs) for cryptocurrencies are a new phenomenon in the quickly changing financial landscape. In this blog, let us explore about the Bitcoin ETF development as it dives into the fascinating intersection of traditional finance and digital assets. We negotiate the nuances of this cutting-edge investment tool and its consequences for businesses, from conception to present.

As a cryptocurrency ETF development company, we will help you understand its importance in the growing business sector.

What is a Spot Bitcoin ETF?

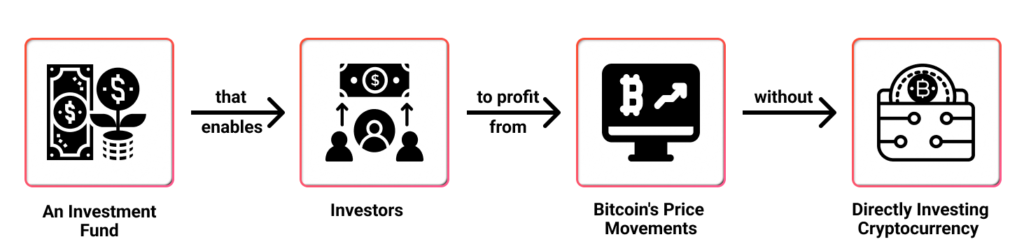

An investment tool called a spot Bitcoin ETF (Exchange-Traded Fund) allows investors to be subjected to real Bitcoin instead of futures or derivatives. Spot Bitcoin exchange-traded funds (ETFs) offer investors a more straightforward and transparent means of investing in the underlying asset than futures-based ETFs because they hold the cryptocurrency directly. The objective of this structure is to monitor the current market value of Bitcoin.

The newly approved ETFs are the first spot Bitcoin ETFs, meaning they are the first cryptocurrency funds to hold Bitcoin directly and trade on a major exchange.

What are the necessary approvals of Bitcoin ETF?

An Exchange-Traded Fund (ETF) for Bitcoin must go through a complex process to get approvals. Getting approvals from financial authorities, managing regulatory environments, and making sure that existing securities laws are followed are all necessary. An additional degree of accessibility and credibility for investors is provided by the ETF’s listing on major stock exchanges, which is a crucial requirement.

ETFs that have received approval provide investors with a controlled way to interact with Bitcoin, which could increase market acceptance and help the cryptocurrency become more widely used. Along with reducing potential risks, these regulatory approvals together create a framework that incorporates Bitcoin into established financial markets, giving investors a regulated way to interact with the cryptocurrency.

How does Bitcoin ETFs Work?

The following steps are the working process when you create a crypto ETF application. Accepted ETFs give investors a regulated way to engage with Bitcoin, which may boost market acceptance and contribute to the cryptocurrency’s broader adoption.

1. Creation of ETF

2. Bitcoin acquisition

3. Creation of shares

4. Listing of exchanges

5. Investor participation

6. Price tracking

This is the complete work-flow one need to know when you develop a crypto ETF application. With the help of our developers, we will help you build a cryptocurrency ETF platform with easy UI/UX.

Read More: Spot Trading On The Binance Clone App: A Step-By-Step Guide

What are the top Bitcoin ETFs?

Now let us look at some of the top ETFs tracking Bitcoin:

1. ProShares Bitcoin Strategy ETF

2. VanEck Bitcoin Strategy ETF

3. Global X Blockchain & Bitcoin Strategy ETF

4. AdvisorShares Managed Bitcoin Strategy ETF

5. Valkyrie Bitcoin Strategy ETF

6. ProShares Short Bitcoin ETF

One has to note that the performance and availability of ETFs can fluctuate due to the dynamic nature of the cryptocurrency market. Before making any investing decisions, make sure you have the most recent information and speak with a financial expert.

What are the main advantages and disadvantages that one has to know about crypto and bitcoin ETF?

The following are some of the benefits and drawbacks of developing a cryptocurrency ETF for a business.

Advantages of Crypto EFTs

Diversification: By providing exposure to a varied portfolio of cryptocurrencies, crypto exchange-traded funds (ETFs) help investors lower the risk involved in investing in individual coins.

Regulated Access: Crypto ETFs are governed by regulatory frameworks, they offer traditional investors a more comfortable and regulated way to invest.

Liquidity: During trading hours, investors can purchase or sell ETF shares on stock exchanges, providing them with flexibility and liquidity.

Simplicity: By removing the need for investors to maintain private keys or wallets, crypto ETFs make investing in cryptocurrencies easier.

Market Integration: ETFs help bring cryptocurrencies into the mainstream of finance, which could draw in a wider group of investors.

Disadvantages of crypto ETFs

Counterparty risk: Investors are at risk from the insolvency or poor management of the ETF issuer or manager.

Discounts and Premiums: When the market price of ETF shares differs from the net asset value (NAV), there may be discounts or premiums associated with it.

Fees: In general terms, in cryptocurrency ETFs, management fees imposed by ETFs can gradually reduce returns.

Limited Control: The ETF manager makes all decisions regarding the purchase and sale of cryptocurrencies, so investors do not have direct control over the underlying assets.

Market Volatility: Because cryptocurrencies are by nature volatile, there may be large swings in the ETF’s value.

Market Manipulation: Due to its youth, the cryptocurrency market is vulnerable to manipulation, which could affect the performance of crypto exchange-traded funds.

One has to carefully analyze these advantages and disadvantages before they launching crypto ETF solutions.

Is it really a good idea to invest in Bitcoin ETF?

Anyone looking to gain exposure to bitcoin without the hassles of direct ownership, investing in a Bitcoin ETF may be a good choice. It provides liquidity, controlled access, and possible benefits of diversification. But it’s important to take into account the fees involved, the counterparty risk of the ETF issue, and the inherent volatility of the cryptocurrency market. Before determining whether a Bitcoin ETF is a good fit for their investment objectives, investors should do extensive research, comprehend the risks, and speak with financial experts.

Who should invest in Bitcoin ETF?

If one is looking for a more conventional approach to invest in digital currency, one viable option is to purchase an ETF that tracks Bitcoin. It can be difficult to invest directly in Bitcoin because you have to consider things like exchanges to use for purchases and asset storage. Crypto futures contracts are packaged into ETF form by ETFs, which reduces some of the complexity.

Along with making it simpler for some institutional investors to enter the cryptocurrency space, the ETF structure may also contribute to the continued high demand for Bitcoin. Due to the increased hacker risk associated with storing Bitcoin in hot wallets, Bitcoin ETFs give institutional investors outside of the mainstream access to the cryptocurrency.

Why one should develop cryptocurrency ETF?

There are many benefits to creating an Exchange-Traded Fund (ETF) for cryptocurrencies. It promotes market integration by giving conventional investors a controlled and easily accessible way to get involved in the cryptocurrency market. Additionally, ETFs make investing easier by doing away with the need for investors to maintain wallets or private keys.

A well-structured cryptocurrency exchange-traded fund (ETF) can draw in a larger investor base by resolving regulatory concerns. This can help to normalize digital assets and close the divide between the rapidly changing cryptocurrency space and traditional finance.

Where can I find the best spot bitcoin ETF development services?

Dappfort is one of the best cryptocurrency ETF development company and when it comes to top-notch Bitcoin ETF development services. Dappfort provides spot Bitcoin ETF development experience from start to finish, with a track record in Blockchain and cryptocurrency solutions. We create reliable and compliant ETF solutions that are customized to your specific needs in the ever-changing cryptocurrency landscape because of their dedication to innovation and in-depth understanding of decentralized finance.

To conclude

ETFs that track cryptocurrencies represent a significant development in the financial markets by offering a regulated link between conventional investments and the ever-changing world of digital assets. These instruments provide investors with a regulated way to deal with the complexity of the cryptocurrency market, with the potential for increased accessibility, diversification, and mainstream adoption. The way that this financial innovation is maturing and how it is changing market dynamics and investment strategies is a fascinating story in the ongoing evolution of finance.