How to Scale Crypto Exchange Business

Launching a crypto exchange is just the beginning. The real test starts when your user base grows, market volumes surge, and your infrastructure has to deliver under pressure.

According to recent industry data, over 60% of new crypto exchanges fail within their first two years—not due to lack of users, but because their infrastructure couldn’t scale. When Bitcoin rallied past $100,000 in early 2025, exchanges that couldn’t handle the surge lost millions in trading volume to competitors.

Scalability is what separates fast-growing exchanges like Coinbase and Kraken from platforms that collapse under their own weight. It’s not just about servers—it’s about how your technology, liquidity, operations, and compliance evolve together.

This guide breaks down what scalability really means for US-based and international exchanges, the challenges you’ll face, and a clear roadmap to help you build a crypto trading platform that can handle long-term growth.

What Is Scalability in a Cryptocurrency Exchange?

Scalability in a cryptocurrency exchange refers to the platform’s ability to handle increasing numbers of users, transactions, and data without any drop in performance.

A scalable exchange maintains:

- Consistent speed: High TPS (transactions per second) and low latency, even during trading peaks.

- High uptime: No system crashes when traffic spikes.

- User experience stability: Smooth trading flow regardless of volume.

- Operational adaptability: Can expand into new regions or assets without major overhauls.

Scalability ensures that your business doesn’t just grow fast — it grows sustainably.

Key Challenges in Scaling a Crypto Exchange

1. Performance Bottlenecks

As traffic surges, system lag, slow order execution, or API delays can destroy user trust. Exchanges that can’t process orders instantly lose active traders fast.

2. Liquidity Constraints

Low liquidity leads to high slippage and poor pricing — two major reasons traders switch platforms. Maintaining deep liquidity becomes harder as trading pairs and user volume expand.

3. Security & Compliance Load

More users mean more data, wallets, and transactions — which increases your exposure to hacks and fraud. Scaling security and compliance systems is just as important as scaling tech.

4. Regulatory Complexity

Each market has its own licensing and tax requirements. Without an adaptable compliance framework, global expansion becomes slow and expensive.

5. Operational Overheads

As you grow, customer support, transaction monitoring, and data handling all increase exponentially. If your operations don’t scale efficiently, costs will spiral.

Transition:

Now that we’ve identified the challenges, let’s explore the pillars of a scalable crypto exchange platform.

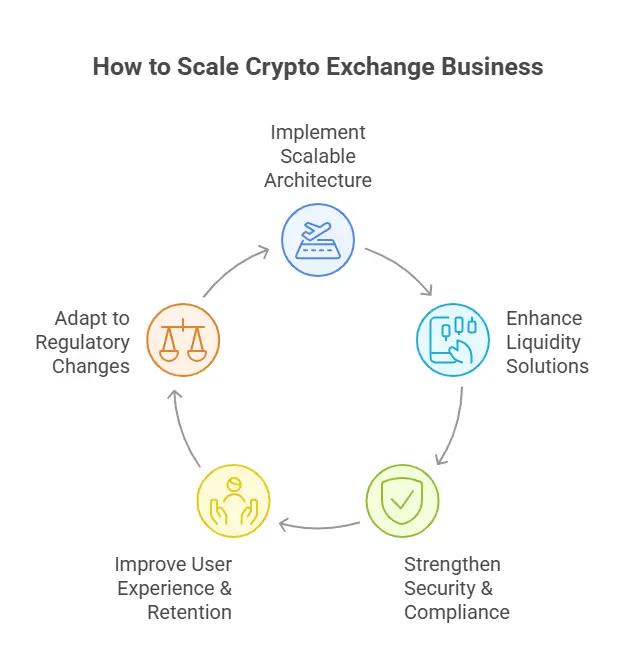

Core Pillars of a Scalable Crypto Exchange

1. Scalable Architecture

Your exchange should be built for elasticity from day one.

- Use microservices to allow independent scaling of components (trading engine, wallet, user management).

- Adopt cloud-native deployment (AWS, GCP, Azure) for auto-scaling and global reach.

- Implement load balancing and caching layers to handle high API requests.

- Use containerization tools like Docker and Kubernetes for flexible deployments.

2. Liquidity Solutions

Liquidity determines whether traders stay or leave. Strengthen it by:

- Connecting to external liquidity pools or aggregators.

- Using automated market makers (AMMs) for decentralized or hybrid models.

- Building internal market-making systems to maintain price stability.

- Offering staking or yield programs to attract liquidity providers.

3. Security & Compliance

A scalable system needs scalable protection:

- Store major assets in cold wallets and enable multi-signature access.

- Implement real-time threat detection, DDoS protection, and 2FA.

- Automate KYC/AML checks and transaction monitoring to handle growth.

- Stay aligned with FATF guidelines and local crypto laws.

4. User Experience & Retention

Performance means nothing if users drop off due to complexity or poor UX.

- Design fast-loading dashboards with clean trading interfaces.

- Offer multi-device accessibility (mobile, tablet, web).

- Simplify onboarding — users should start trading in under 3 minutes.

- Use AI-driven personalization for trade suggestions or portfolio insights.

5. Regulatory Adaptability

Scaling across borders requires flexibility:

- Create a compliance layer that can be localized for each region.

- Work with legal experts to navigate regional restrictions.

- Prioritize licensing in crypto-friendly zones (UAE, Singapore, EU).

Layer 2 & Blockchain Optimizations

To handle high transaction volumes at lower costs, exchanges can leverage Layer 2 solutions, sidechains, and sharding.

- Layer 2 rollups move most transactions off-chain, reducing congestion and gas fees.

- Sidechains allow faster, lower-cost transactions while keeping assets secure on the main chain.

- Sharding splits transaction loads into smaller units, enabling parallel processing and higher throughput.

These optimizations complement your backend infrastructure, improving transaction speed and efficiency during peak trading times.

Key Metrics to Measure Scalability

You can’t improve what you don’t measure. Track these KPIs:

- Transactions per Second (TPS): Speed of order execution.

- Average Latency: Time between order placement and confirmation.

- Uptime Percentage: Anything below 99.9% is risky.

- Active User Retention Rate: Indicates user satisfaction and trust.

- Liquidity Depth: Order book strength for top trading pairs.

- Server Utilization Rate: Helps identify resource bottlenecks.

Why Scaling a Crypto Exchange Is Critical for Long-Term Success

Scalability isn’t optional for a crypto exchange — it’s the foundation of survival and growth.

A scalable platform can:

- Handle sudden market surges (like Bitcoin rallies).

- Retain users through stable performance.

- Expand into new markets fast.

- Build institutional confidence through reliability and compliance.

scalability builds credibility, and credibility attracts volume — the ultimate growth loop.

Common Pitfalls to Avoid When Scaling

- Ignoring regulatory updates during expansion.

- Over-reliance on a single liquidity provider.

- Neglecting system monitoring and maintenance.

- Poor communication between development and compliance teams.

- Scaling infrastructure before validating market demand.

Avoid these, and your growth curve stays stable.

Conclusion

Scaling a crypto exchange is a long-term commitment — not a one-time fix. It’s about designing for adaptability, automating intelligently, and thinking globally from the start.

When technology, liquidity, and compliance grow in sync, your exchange becomes not just scalable — but unstoppable.

If you’re looking to build or upgrade your platform, partnering with a trusted Dappfort crypto exchange development company can ensure your exchange is designed to scale efficiently, handle high trading volumes, and meet compliance requirements.

If you’re building or upgrading your crypto exchange, focus on scalability early. The more you prepare today, the faster and safer you’ll grow tomorrow.

Instant Reach Experts:

WhatsApp : 8838534884

Email : sales@dappfort.com