How Dappfort Develops a Uniswap Like DEX?

Our professionals follow a structured flow to develop a Uniswap-like DEX, and here is the overview of the flow our team follows

Requirement Analysis

We start by analyzing your business goals, identifying essential features, and defining a roadmap for developing a robust DEX platform.

UI/UX Design

Our design team creates intuitive, user-friendly, and engaging interfaces that enhance trader experience and simplify navigation across the DEX.

Smart Contracts

We develop and audit smart contracts to automate trades, manage liquidity pools, and ensure transparent, secure, and efficient exchange operations.

Blockchain Integration

The DEX is integrated with blockchain protocols, enabling multi-chain compatibility and ensuring seamless token swaps across different networks.

Backend Development

We build a strong backend infrastructure using secure, scalable technologies that handle large transaction volumes efficiently and without downtime.

Wallet Integration

The platform supports major crypto wallets, ensuring smooth and secure wallet connectivity for instant trading, staking, and liquidity contributions.

Testing Phase

Rigorous functional, security, and performance testing is conducted to ensure the platform delivers flawless, reliable, and secure trading experiences.

Deployment Launch

After thorough testing, we deploy the DEX platform on the selected blockchain, ensuring stable operations and immediate market readiness.

Post-Launch Support

Our experts provide continuous support, upgrades, liquidity assistance, and security monitoring to maintain the long-term success of your DEX.

How Decentralized Exchange like Uniswap Work?

This simple yet powerful process makes Uniswap-like DEX platforms secure, transparent, and fully user-controlled for seamless crypto trading

Step 1

Wallet Connection

Users connect their crypto wallets directly to the DEX, enabling seamless access without account creation or third-party intermediaries.

Step 2

Liquidity Pools

Traders and investors deposit tokens into liquidity pools, which power transactions and maintain continuous trading activity on the platform.

Step 3

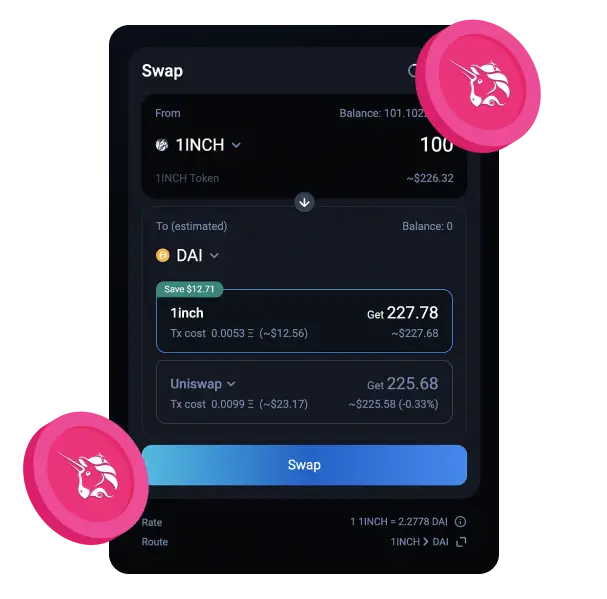

Automated Market Maker

Smart contracts and AMM algorithms calculate token prices automatically, ensuring fair value swaps based on supply and demand dynamics.

Step 4

Token Swaps

Users execute instant peer-to-peer token swaps from liquidity pools, with transactions processed transparently on the blockchain without delays.

Step 5

Fund Security

Unlike centralized exchanges, DEXs never hold user funds, giving traders complete control, security, and ownership of their digital assets.

Benefits of Launching a Uniswap Clone

With these advantages, a Uniswap Clone empowers you to build a secure, profitable, and future-ready decentralized exchange platform.