Benefits of Launching a Centralized Exchange Solution

Launching a centralized exchange provides businesses with significant opportunities to grow in the digital asset industry. These platforms deliver reliability, trust, and revenue potential, making them one of the most effective models for crypto-based businesses.

Revenue Streams in Centralized Exchange Platforms

Centralized exchanges generate multiple revenue streams that make them highly profitable businesses. By offering diverse services, platform owners can maximize income while also providing traders with more options and better experiences.

Trading Fees

Exchanges earn steady revenue by charging users a small fee on every trade, which creates consistent income from daily activity.

Withdrawal Fees

Platforms collect withdrawal fees whenever users move cryptocurrencies or fiat money out of their exchange wallets, adding reliable revenue.

Listing Fees

Crypto projects pay exchanges to list their tokens, giving the platform income while increasing available trading options for users.

Margin Trading Fees

Exchanges generate revenue when users borrow funds for trading, collecting interest and fees on leveraged transactions carried out

Staking and Lending Services

Offering staking and lending allows exchanges to earn commissions while enabling users to grow earnings from their existing assets.

Token Sales and IEOs

Hosting token sales and Initial Exchange Offerings creates income for exchanges while helping new crypto projects raise early funding.

Popular Centralized Crypto Exchange Clones We Offer

At Dappfort, we provide ready-to-launch centralized cryptocurrency exchange clones that replicate the success of leading platforms. Each clone solution comes with powerful features, customizable options, and secure architecture, allowing businesses to quickly establish their own exchange and compete effectively in the crypto market.

Binance Clone

Our Binance Clone replicates the features of Binance, offering multi-currency support, advanced trading tools, and complete customization for businesses.

Paxful Clone

Our Paxful Clone helps you launch a user-friendly P2P exchange with features that prioritize privacy, affordability, and reliable performance.

Coinbase Clone

We deliver a Coinbase Clone that supports scalability and regulatory compliance, ensuring a trusted trading experience for global crypto investors.

Remitano Clone

Our Remitano Clone provides seamless fiat-to-crypto transactions and escrow protection, enabling businesses to build a secure and efficient P2P platform.

Centralized Crypto Exchange Development Process

The centralised crypto exchange development process defines the core technical steps required to design, build, secure, and deploy a production-grade trading platform.

Discovery

Gather technical requirements, target markets, compliance needs, feature set, and throughput goals to define scope and system specifications.

Architecture

Design a modular, scalable system architecture using microservices, database sharding, load balancers, and redundancy for high availability and fault tolerance.

Frontend

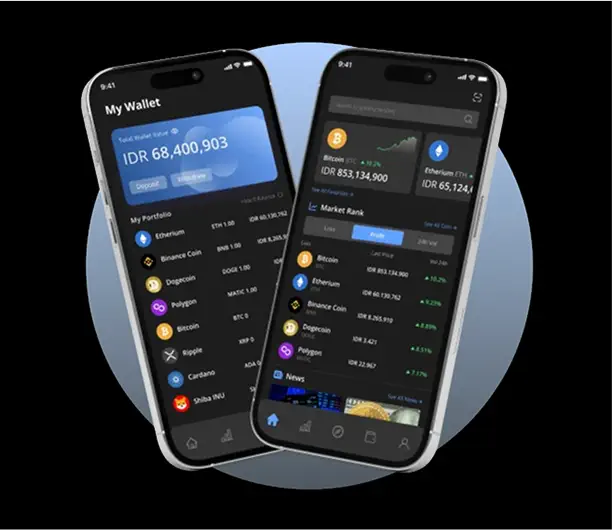

Develop responsive, low-latency web and mobile interfaces using React or Vue and native frameworks, prioritizing usability and performance.

Backend

Implement a low-latency matching engine, order management, trade execution services, account ledger, and real-time websocket data feeds for traders.

Wallets

Integrate secure hot and cold wallet architecture, multi-signature custody, encryption for private keys, and automated withdrawal approval workflows.

Integrations

Connect liquidity providers, fiat on-ramps, payment gateways, price oracles, and KYC/AML provider APIs to enable full platform operations.

Testing & Deployment

Perform security audits, penetration and load testing, then deploy via CI/CD pipelines with monitoring, observability, and rollback strategies in place.

Quality check

No points flagged as stretched or unnatural. If you want any step shortened, expanded, or rewritten, tell me which step and I’ll update it after your approval.